Multi-Family Insights | December 2024

CENTRAL VALLEY REAL ESTATE NEWS

The multi-family investment market in the Central Valley has slowed significantly from its peak just a few years ago. This year has seen only 47 transactions, 56% fewer than the 107 transactions recorded during the same period in 2018.

Despite the sharp decline in deal velocity, average CAP rates today are very similar to those in 2018: 6.00% in the first three quarters of this year compared to 6.26% in 2018.

IMPACT OF TREASURY YIELD ON MARKET DYNAMICS

Historical Treasury Yield Comparison

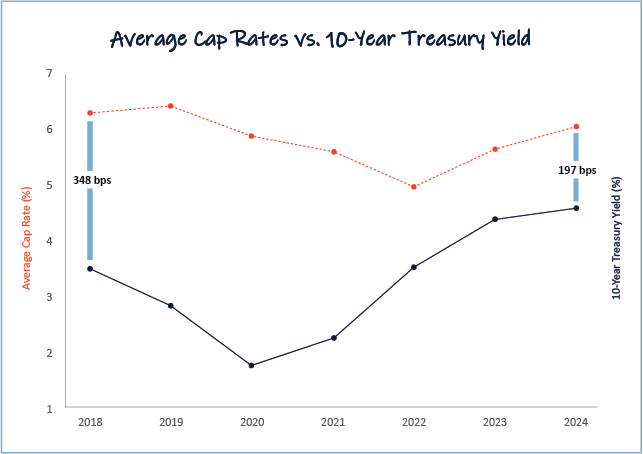

A significant rise in the 10-year Treasury yield has reshaped the investment landscape. The median yield increased from 2.78% in 2018 to 4.03% in 2024—a 125 basis point jump. This has compressed the spread between CAP rates and Treasury yields, reducing transaction activity.

Delta in CAP Rates and Treasury Yields

The spread between CAP rates and Treasury yields shrank from 348 basis points in 2018 to 197 basis points in 2024, a 151-basis point reduction. This has two key impacts:

- Loan-to-Value Ratios: A smaller spread leads banks to tighten lending, offering lower loan-to-value ratios and requiring investors to put down more cash, thus limiting buyer activity.

- Investor Returns and Leverage: Wider spreads help preserve returns when using debt and can even create positive leverage, where returns increase through the strategic use of debt. However, the reduced spread in 2024 has made debt financing less appealing for investors.

Contact us to discuss market insights or strategies to enhance and preserve the value of your investments.