Central Valley Retail Investment Trends: Industry Insights

Central Valley Retail Investment Trends for 2024: Industry Insights

The real estate market in California’s Central Valley is evolving, with retail property investments undergoing significant shifts. Rising cap rates, new state legislation, and changing seller motivations are reshaping the landscape. Whether you’re an experienced investor or new to the market, understanding these trends is key to maximizing returns and navigating opportunities effectively.

Market Overview: The Shift in Cap Rates

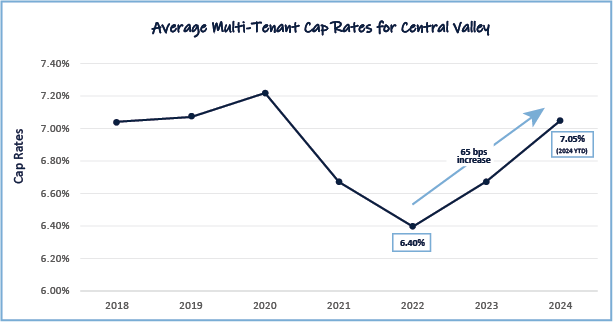

Since 2022, retail property values in the Central Valley have steadily declined, driven by rising cap rates. As of 2024, the average cap rate for multi-tenant retail properties is 7.05%, a 65 basis-point increase from the recent peak of 6.40% in 2022. While this may seem significant, the current average is still slightly below the 10-year historical average of 7.10%, aligning with pre-COVID figures from 2018-2019.

This adjustment signals a return to normalcy in many respects, but investors must remain vigilant. Rising cap rates can offer opportunities for higher yields but may also indicate broader economic shifts affecting property values.

Key Takeaway: Stay informed about cap rate trends to assess the right time for purchasing or selling investments.

Understanding Seller Motivations

The motivations behind selling multi-tenant retail properties are evolving. According to Visintainer Group’s research, the most common reasons include:

- Upcoming Loan Maturities & Rising Interest Rates: Increasing interest rates make it more challenging for property owners to refinance loans.

- Reducing Management Responsibilities: Some sellers aim to minimize the effort and unpredictability tied to managing multi-tenant properties.

- Navigating Legislative Changes: California’s changing regulatory landscape is prompting many to utilize a 1031 Exchange to purchase property in other states.

Insight: Sellers looking to escape income volatility or burdensome management responsibilities may find opportunities to optimize returns in different markets.

Impact of Minimum Wage Increases (AB 1228)

California’s new wage legislation (AB 1228) has introduced a $20 per hour minimum wage for fast-food workers as of April 1, 2024. This is a significant jump from the average $16.21 hourly wage in 2022 and applies to fast-food chains with 60 or more locations nationwide.

Implications for Investors:

- Rent Collections: Landlords are reporting increased tenant struggles with rent payments.

- Lease Renewals: Some tenants are leveraging this change to negotiate lower rents or shorter terms.

- Business Growth: New store openings and lease signings are slowing down in response to higher operational costs.

For further details on AB 1228, visit the California Director of Industrial Relations.

Strategic Considerations for Investors

With market conditions in flux, how should investors respond?

- Stay Informed: Regularly track cap rate trends and market dynamics to identify optimal opportunities.

- Evaluate Property Conditions: Consider whether rising operational costs and tenant challenges might affect the value of potential acquisitions.

- Consult Experts: Leverage industry expertise, such as the services provided by the Visintainer Group, to navigate complex decisions effectively.

Pro Tip: Staying proactive about legislative updates and economic indicators will give you a competitive edge.

Why Partner with the Visintainer Group?

Navigating the complexities of multi-tenant retail investments requires a trusted partner. The Visintainer Group offers unparalleled expertise in the Central Valley market, helping investors buy, sell, and manage retail properties strategically.

Services Include:

- Comprehensive market analysis

- Customized investment strategies

- Support for navigating legislative impacts

Whether you’re looking to expand your portfolio or adjust your strategy, the Visintainer Group provides the insights you need to succeed.

Wrapping Up

The Central Valley retail investment landscape presents both challenges and opportunities. By understanding market trends, evaluating property dynamics, and staying informed about legislative changes, you can position yourself for success. Don’t navigate these changes alone—reach out to the Visintainer Group for advice tailored to your unique needs.

Contact Us Today

- John Kourafas, CCIM

- Email: [email protected]

- Phone: 559.890.0419