In today’s dynamic commercial real estate landscape, investors are increasingly choosing to sell their properties. Whether motivated by financial shifts, partnership changes, or new legislation, many commercial real estate owners are opting to liquidate their assets for a variety of reasons. Below, we explore the top five motivations we have observed in today’s market behind why commercial real estate investors are selling.

1. Upcoming Loan Maturity and Rising Interest Rates

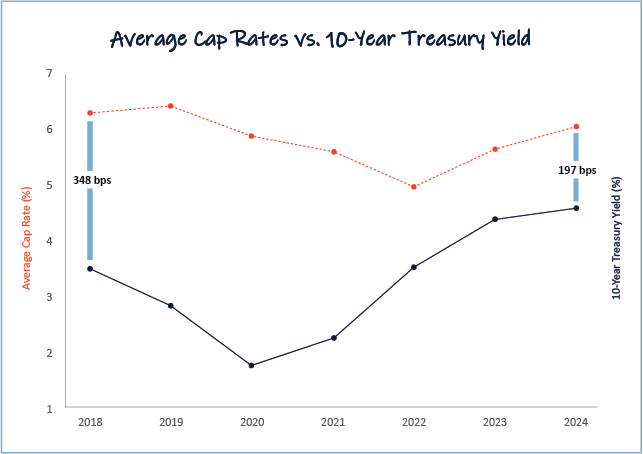

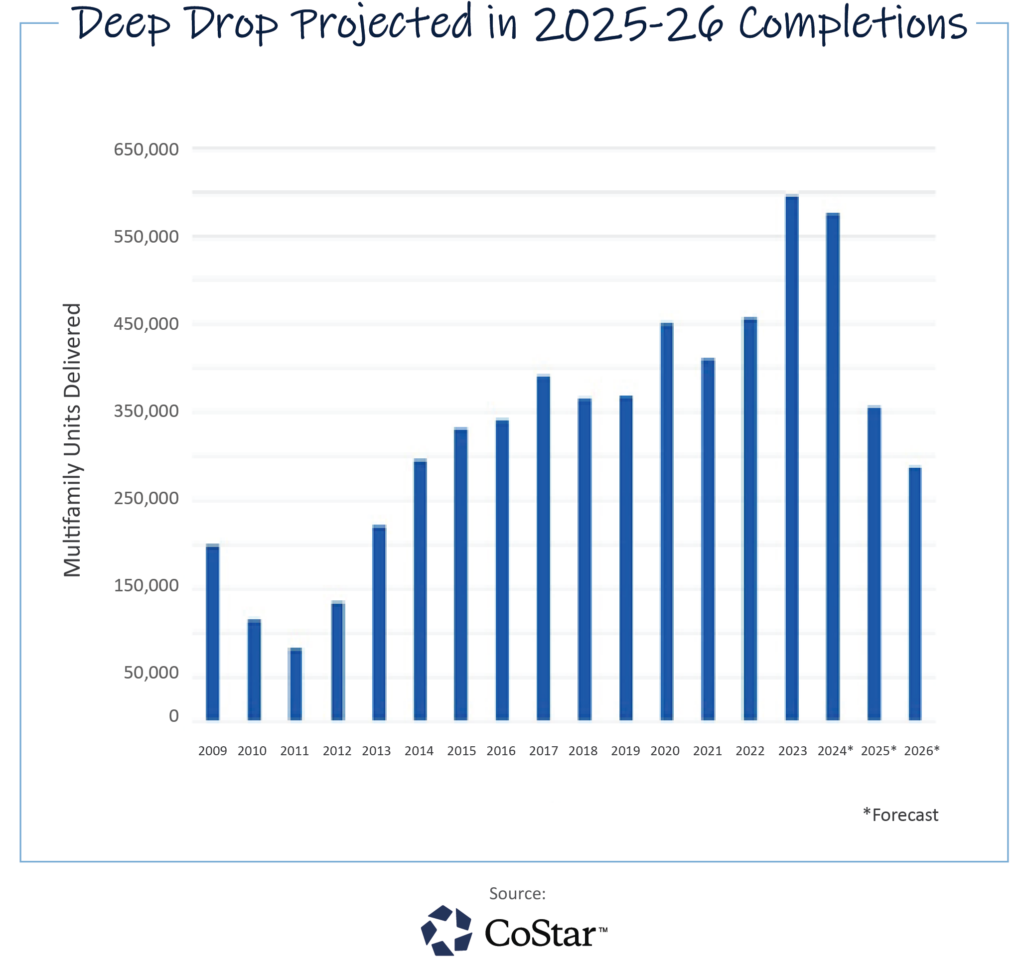

One of the primary reasons driving commercial real estate owners to sell is the impending maturity of their loans. As interest rates have risen over the last two years, refinancing becomes less favorable, resulting in higher debt service and lower income. This financial strain is causing many investors to reconsider holding their properties. In some cases, refinancing may even require additional funds, prompting owners to fire sale rather than absorb higher costs.

2. Reducing Day-to-Day Management Responsibility

As investors age or their personal priorities shift, the responsibilities tied to managing commercial real estate can become burdensome. Properties that demand hands-on management—such as retail centers, office buildings, and industrial spaces—can weigh heavily on owners who are looking to simplify their portfolios. Many investors are selling their assets to reduce the daily management obligations associated with these properties and have elected to re-invest in single tenant net lease properties with longer leases, with zero to minimal LL responsibility within the lease, and guarantees from regional/national tenants to achieve truly passive cash flow.

3. Navigating New Legislation in California

California, in particular, is seeing a significant impact from changing laws and regulations. Legislation aimed at altering property values, income generation, and operational expenses is forcing some owners to rethink their investments. For many, the complex legal landscape and the increased costs of compliance have led to the decision to sell. Many owners have elected to 1031 exchange their current California assets out of state. Additionally, these market conditions create opportunities for new buyers who are prepared to navigate these challenges.

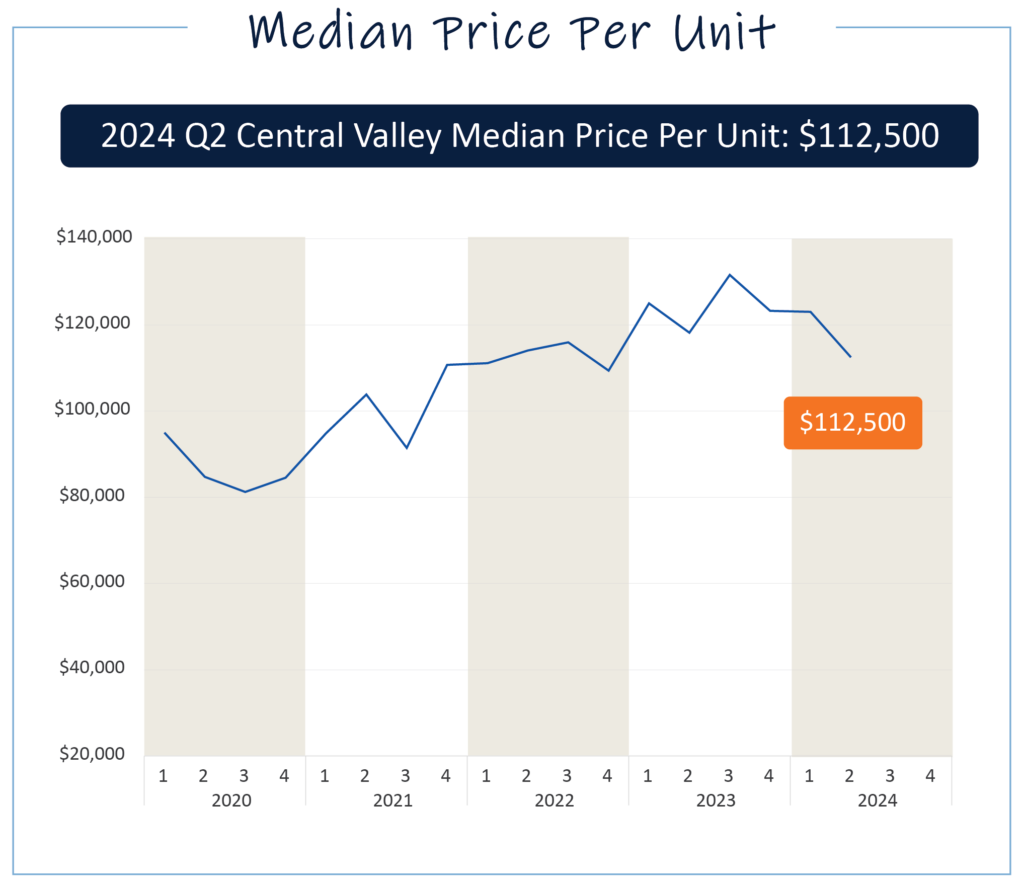

4. Portfolio Diversification in Response to Market Fluctuations

Recent market volatility has led many commercial real estate investors to diversify their portfolios. Some investors are selling their current holdings to invest in different asset classes or geographical areas. By spreading risk across multiple investments, owners aim to safeguard their capital while taking advantage of new opportunities in alternative markets or sectors.

5. Partnership Splits and Asset Distribution

As business partnerships evolve or dissolve, selling properties often becomes the easiest way to equitably divide assets. Partnership splits can occur for various reasons, such as retirement, differing financial goals, or the desire to pursue other ventures. Selling the property ensures a clean exit strategy for all involved parties and allows for the equitable distribution of any proceeds.

How Visintainer Group Can Help

At Visintainer Group, we understand the complexities of commercial real estate transactions and are committed to helping investors make informed decisions. Our team offers a range of services designed to help your clients navigate the acquisition, hold or disposition of properties, with confidence and ease.

Complimentary Property Valuations

For investors considering a sale or simply curious about where their property stands today, we provide no-cost property valuations. These valuations allow property owners to assess the current market value of their assets and explore reinvestment options. Our team works closely with each client to ensure they receive the most accurate information, helping them make well-informed decisions.

Expertise in 1031 Exchange Transactions

One of the most effective strategies for investors looking to defer capital gains taxes after a sale of their property is through a 1031 Exchange. This beneficial tax code allows an owner to sell one piece of profit-making real estate and use the proceeds to purchase other profit-making real estate.

At Visintainer Group, we offer a uniquely tailored approach to protect your assets, guiding you through the complex and time-sensitive 1031 Exchange process. Our proprietary system ensures a seamless transaction, minimizing the risks associated with tight deadlines. With our extensive national network, you also gain exclusive access to off-market properties, providing unparalleled opportunities to diversify your portfolio and maximize returns.

Navigating Today’s Market with Confidence

Selling commercial real estate in today’s market can be a strategic decision influenced by many. At Visintainer Group, we specialize in guiding investors through this process, offering tailored solutions that align with their individual needs and long-term goals. From complimentary property valuations to expert assistance with 1031 exchanges, we provide the tools and insights necessary for investors to achieve their objectives.