Multi-Family Insights | September 2024

CENTRAL VALLEY REAL ESTATE NEWS

KEY MARKET TRENDS

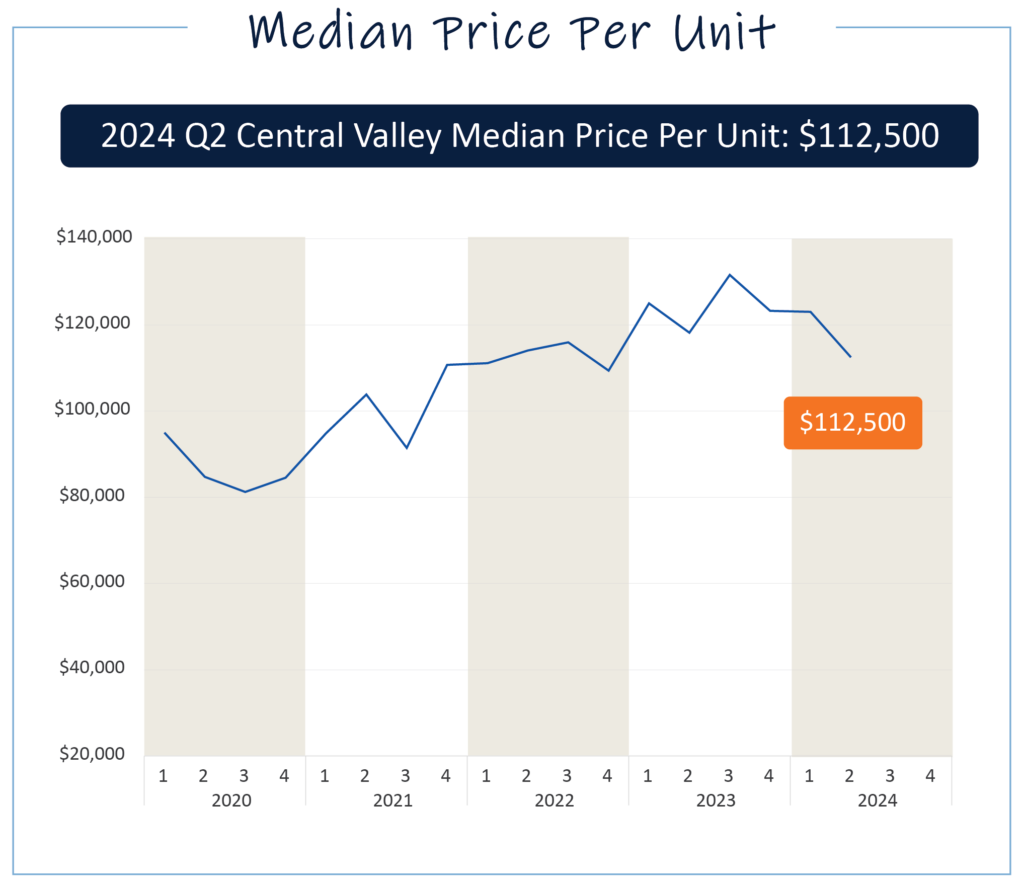

Market Price Trends

Since Q3 2023, the Central Valley real estate market has been impacted by high interest rates, resulting in a 14.5% decline in the median price per unit, now at $112,500. However, prices remain higher than the median pricing in 2021, which was $99,000.

Rent Growth

Rent growth in the region has been modest, ranging between 2-3% over the past year. Many investors are choosing not to raise rents due to concerns over potential vacancies, as the cost of renovations often outweighs the benefit of modest rent increases.

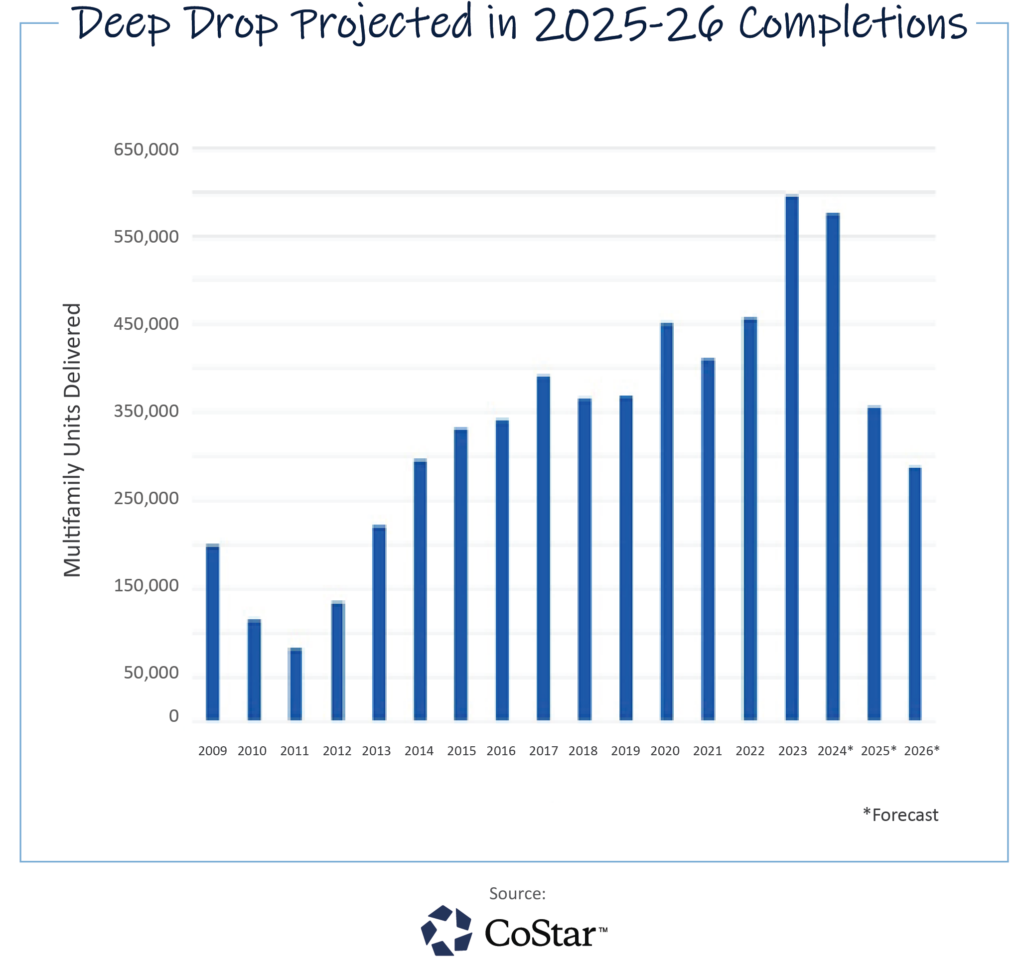

New Construction Slowdown

New construction starts have slowed significantly. Projections from CoStar indicate a nationwide reduction in new unit deliveries, with a 38% decrease expected in 2025 and another 16% in 2026. While some investors are optimistic that reduced supply could boost rent growth, the long-term effects remain uncertain.

REGULATORY UPDATES

Legislation Watch: California’s Proposition 33

Looking ahead to November, there is growing concern over Prop. 33, also known as the Justice for Renters Act. If passed, this legislation would allow local governments to impose rent controls on vacant units, which could discourage investment in property maintenance and renovations, ultimately impacting the quality of available housing.

RISING INSURANCE COSTS

Insurance premiums have surged in recent years, becoming a significant financial burden for property owners. Over the past four years, many premiums have tripled, with some reaching nearly $1,000 per unit—especially for properties built before 1990. This trend further complicates the economics of property ownership in the region.

WRAPPING UP

The dynamics of the Central Valley’s multi-family market present both opportunities and challenges. Understanding these trends is essential for making informed decisions—whether you’re managing investments or supporting them through strategic partnerships. Our team is here to help you navigate these developments with tailored expertise.

*Data courtesy of Visintainer Group and CoStar Analytics